Not many people know this.....( I didn't ).....probably affects Gumtree too......believed to affect Aliexpress / Alibaba and possibly ALL goods on sale in UK from abroad ?

It is due to new Customs & Excise regulations to remedy the problem of loss of revenue to the Exchequer and unfair advantage to foreign suppliers, regarding clearance into the UK of goods from abroad. ( Not Brexit as you might expect, but a coincidental and long overdue review of how we treat foreign goods and ensure fair competition ). See here :-

https://www.gov.uk/government/publi...s-goods-sold-to-customers-from-1-january-2021

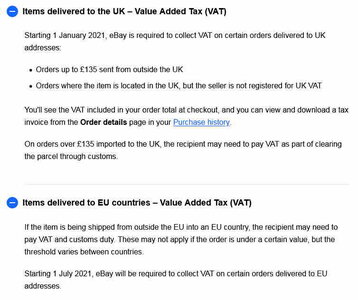

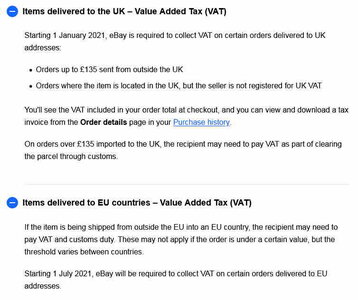

Summary - From the 1st January 2021, eBay will be adding VAT at 20% to most prices / purchases delivered to the UK

( please check, if you have your eye on any such goods, as they may have gone up by 20% ! )

on

Items under £135

Items located in the UK, where the sellers are not VAT registered

( Tbh, I'm not sure even eBay have interpreted this correctly ! )

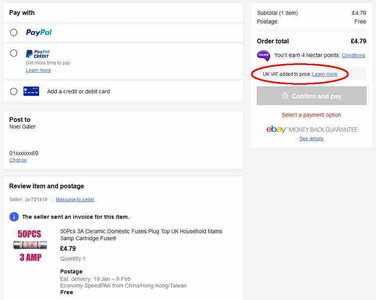

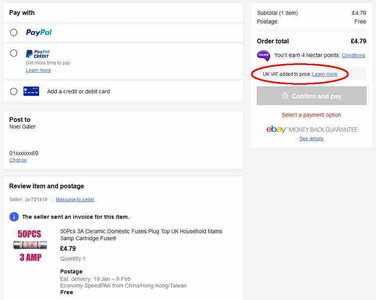

Click on 'Learn More', next to the new VAT uplift warning, during eBay Checkout as per the example within the Red Ring on the picture shown :-

The item shown was purchased before Jan 1st 2021 and was bought at £3.99 ! It hasn't been paid for, because similar changes are being made at PayPal, which have effectively disabled my account, so I couldn't pay !

...or you could follow this link ( see right at the bottom after all the US Sales Tax stuff ) :-

https://www.ebay.com/help/buying/pa...query=Paying tax on eBay purchases&intent=tax

or see a relevant extract here :-

I spent quite a while trying to fix what appeared to be anomalies at PayPal and eBay before I realised what the problem was. ( I thought I'd bought something for £3.99 and didn't understand why I was being asked to pay £4.78 ). Customer support staff at BOTH eBay and PayPal did not know what was happening either and still don't as far as I know - scary !

Personally, I'm not happy to have to pay 20% more on foreign goods, why should I be ? However, looking again at eBay for 3A fuses and competing products, there is a UK supplier offering them at £5.15 for the same item. In hindsight, I would definitely have bought those instead, happily supporting a UK supplier, getting them a fortnight sooner and only spending a few pennies more - So I think this is ultimately a GOOD THING for UK businesses and the UK generally !

MODS - If you are not happy with this post being in this thread ( although it seems ideally placed imho ), please do not delete it, as it took time to research, type and check. Perhaps you would instead kindly move it to another, more relevant thread if you consider it necessary. Thank you...

It is due to new Customs & Excise regulations to remedy the problem of loss of revenue to the Exchequer and unfair advantage to foreign suppliers, regarding clearance into the UK of goods from abroad. ( Not Brexit as you might expect, but a coincidental and long overdue review of how we treat foreign goods and ensure fair competition ). See here :-

https://www.gov.uk/government/publi...s-goods-sold-to-customers-from-1-january-2021

Summary - From the 1st January 2021, eBay will be adding VAT at 20% to most prices / purchases delivered to the UK

( please check, if you have your eye on any such goods, as they may have gone up by 20% ! )

on

Items under £135

Items located in the UK, where the sellers are not VAT registered

( Tbh, I'm not sure even eBay have interpreted this correctly ! )

Click on 'Learn More', next to the new VAT uplift warning, during eBay Checkout as per the example within the Red Ring on the picture shown :-

The item shown was purchased before Jan 1st 2021 and was bought at £3.99 ! It hasn't been paid for, because similar changes are being made at PayPal, which have effectively disabled my account, so I couldn't pay !

...or you could follow this link ( see right at the bottom after all the US Sales Tax stuff ) :-

https://www.ebay.com/help/buying/pa...query=Paying tax on eBay purchases&intent=tax

or see a relevant extract here :-

I spent quite a while trying to fix what appeared to be anomalies at PayPal and eBay before I realised what the problem was. ( I thought I'd bought something for £3.99 and didn't understand why I was being asked to pay £4.78 ). Customer support staff at BOTH eBay and PayPal did not know what was happening either and still don't as far as I know - scary !

Personally, I'm not happy to have to pay 20% more on foreign goods, why should I be ? However, looking again at eBay for 3A fuses and competing products, there is a UK supplier offering them at £5.15 for the same item. In hindsight, I would definitely have bought those instead, happily supporting a UK supplier, getting them a fortnight sooner and only spending a few pennies more - So I think this is ultimately a GOOD THING for UK businesses and the UK generally !

MODS - If you are not happy with this post being in this thread ( although it seems ideally placed imho ), please do not delete it, as it took time to research, type and check. Perhaps you would instead kindly move it to another, more relevant thread if you consider it necessary. Thank you...