New VED rates post March 1st 2001

- Thread starter TopCat1127

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Just had this pointed out........

Band K ......... *Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

Still 330 vs 270

Band K ......... *Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

Still 330 vs 270

No that refers to post march 1st 2001 to 23rd march 2006 when new manufacturing regs kicked in, so anything between those dates is in band K unless new regs were in force for new designs, not end of line production

I haven't looked at the Budget so I didn't know about this, but it's a bit of a shocker.

Stinging people who own 20-year-old cars isn't going to help the government's ledger very much, but it's really going to hurt individuals who - quite reasonably - are running a perfectly functional car with years left in it.

Assuming that car lasts for another 10 years, it's still going to produce less emissions than the production of a new car, (unless the manufacturers have managed to circumvent the 2nd law of thermodynamics).

Stinging people who own 20-year-old cars isn't going to help the government's ledger very much, but it's really going to hurt individuals who - quite reasonably - are running a perfectly functional car with years left in it.

Assuming that car lasts for another 10 years, it's still going to produce less emissions than the production of a new car, (unless the manufacturers have managed to circumvent the 2nd law of thermodynamics).

Lol my Mondeo still comes in at £165 so not too bad.

Chris is totally correct, but will the powers that be ever see that? Not on your life!

Chris is totally correct, but will the powers that be ever see that? Not on your life!

The government are hoping that they will get rid of their old 'polluting' car and buy a new nice clean car from a company who's in their pockets and a nice bit of sales tax and all the trimmings to boot

Read through the posts Chris, seems i misunderstood lol

If you were wrong, it's quite reasonable - The C2s were always higher taxed before based on the date of production, weren't they?

not end of line production

If I'm reading it right that bit is key, assuming that the government sees all Cougars the same (even if we don't). If so, that's actually an improvement on the previous situation. Slightly.

Quite relieved my SLK sneaks into band K as per Tony's comment before so only going up a tenner and that's all any Cougar will get stung for luckily as later ones also fit in band K.

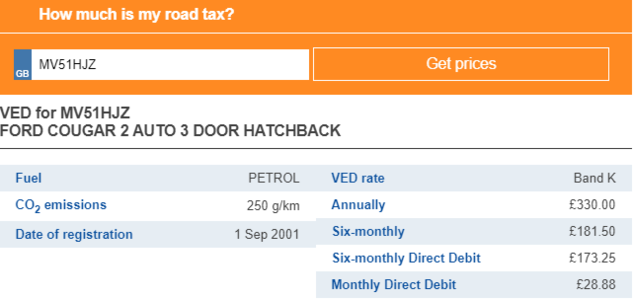

You can calculate your new tax in the box near the bottom just put reg number in.

You can calculate your new tax in the box near the bottom just put reg number in.

Honest John can’t recognise my reg but following the pre 2001 link shows £145.75 for 6 months and £280 for the year.

My memory, which is crap, seems to say this is less but I could be wrong.

My memory, which is crap, seems to say this is less but I could be wrong.

Specified, tested or declared?

Specified: Tested by Ford.

Tested: MOT emissions readout.

Declared: Specified plus a margin to allow for tolerence.

I'm taking the DVLA-recorded value as being declared, typical value across production samples to give a tax-rate benchmark.

Specified: Tested by Ford.

Tested: MOT emissions readout.

Declared: Specified plus a margin to allow for tolerence.

I'm taking the DVLA-recorded value as being declared, typical value across production samples to give a tax-rate benchmark.